The Merchant Service Advisor Blog is our forum to share our thoughts and the experiences of our merchants to help you make a better decision about what company you should choose to process your credit card transactions. There's a tremendous amount of mis-information perpetuated by inexperienced sales reps and disreputable companies in the credit card processing industry, so this blog is our way to help you learn what's important in a frank, straightforward manner. Our goal is to empower you to make a better decision and demonstrate that Winery Payment Solutions doesn't play games with your money.

February 2014

Thanks for entering our iPad Air giveaway at the Unified Wine and Grape Symposium, the winner is…..

Diane Bucher of Bucher Vineyards in Healdsburg, CA. Congratulations Diane, and thanks to the over 400 people who entered our drawing.

January 2014

Now available directly from Winery Payment Solutions, the best mobile processing solution for wineries processing under $2,000 per month in credit cards. Our partner Flint offers the lowest rates available anywhere 1.95% for card present transactions and 2.95% for manually entered transactions.

Signup now for this simple card system.

January 2014

Can’t wait to see everyone at the Unified Wine and Grape Symposium in Sacramento. Stop by our booth on the 3rd floor and enter our iPad Air giveaway.

Also, we still have a few free entry vouchers available for the show, so call us and we’ll get you into the exhibit areas for free. Call us at 707-674-5111 for your tickets.

November 2013

We have a limited number of free admission to the exhibit hall at both the WIN – Wine Industry Network Conference in Sonoma, CA on 12/5 and the Unified Wine and Grape Symposium in Sacramento, CA on 1/28-1/30. Please contact us at 800-993-6300, and we’ll gladly get you a free pass to either or both of these industry trade shows.

June 2013

On average tasting rooms who switch to Winery Payment Solutions for their credit card processing save 30% in processing fees versus their current provider. The savings is possible only with our cost pass-through account, so the actual costs or interchange fees as dictated by Visa, MasterCard, Discover and American Express are passed to you at cost and our only fee is a tiny markup that’s fully disclosed and detailed on your statements.

We only support interchange based pricing for your merchant account as it’s the only open, honest and transparent way to support your winery. The largest retailers such as Target and Wal-Mart receive interchange pricing, it’s time for your winery to receive the same pricing as the biggest retailers.

We’ll gladly show you our actual costs so you always know the real costs to accept credit cards. No gimmicks, this is your business and you deserve an honest partner who understands the needs of your winery and is not afraid to share the secrets that you need to get the lowest possible costs.

For details please contact Winery Payment Solutions at 707-674-5111 or sales@winerypaymentsolutions.com

December 2012

We won the paparazzi award at the Wine Industry Network Conference in Santa Rosa this week. We’ve seen this photo all over facebook and twitter with our light-hearted message. That’s right, we’ll help your winery seal up your bottom line with simply better credit card processing. Don’t let your profits leak away.

October 2012

On Wednesday, December 5th Winery Payment Solutions will be exhibiting at the North Coast Wine Industry Expo at the Sonoma County Fairgrounds in Santa Rosa. The Expo will feature the industry’s best suppliers and will showcase the latest innovations, services, and solutions that will help your winery succeed in 2013. We’re expecting a great event and we’d like to invite you as our guest to attend the trade show for free.

Your complimentary show-only pass gives you FREE admission to the trade show and access to our booth where we will be displaying our latest internet, mobile and point of sale solutions for your winery.

Space is limited, so reserve your spot by Clicking Here for the registration page. Enter our promo code “ WIN19 “ to be given free access to the Trade Show Floor (a $20 value). Educational Conference Sessions are not included in this offer.

See you at Booth #19

July 2011

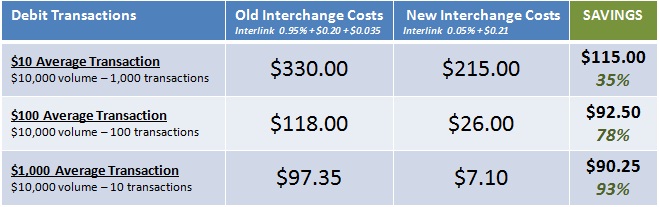

The Federal Reserve Board announced the final debit interchange caps related to the Durbin amendment. Some say that the Fed succumbed to pressure from the banks to retain most of the current rate structure, but savings will still be available to business owners. The Fed had previously proposed a debit interchange cost cap of $0.12, but the official cap imposed will be: $0.21 per transaction and 0.05%. This still represents a significant savings for your winery, but not quite as much as anticipated. Currently Interlink, the largest debit network, charges 0.95% and $0.20 per item plus an assessment of $0.035, so how will the new fee caps impact your bottom line?

For a Winery Payment Solutions client on the cost for debit transactions will decline from 0.7% to 1.15% depending upon your average transaction size and the specific debit network used for the transaction. In the examples above the new caps will reduce the actual cost of debit transactions from 35% to a whopping 93% for your winery.

While the Fed only sets the rate caps and each Debit network can price their service up to that cap, we’d be surprised if any Debit network prices their services under the current maximum amount allowed by law. This new cap’s implementation was also delayed from July 21, 2011 to October 1, 2011; so business owners will have to wait for a few more months to start seeing the savings.

Winery Payment Solutions is excited about these interchange caps imposed by the Fed as our clients will see significant savings on their debit transactions. If you’re not with Winery Payment Solutions already, make sure that your credit card processor is looking out for your best interests and will be passing along all the savings to your bottom line.

June 2011

The Federal Reserve has been granted the authority to regulate the costs charged by banks for Debit card transactions due to implementation of the Durbin Amendment. The revised cost that the Fed has proposed for Debit transactions is $0.12 per transaction, which is significantly lower than the rates currently charged. For example, Visa – the largest debit card processor through their Interlink network – currently charges 0.95% plus $0.235 per transaction for debit card transactions. The proposed changes are scheduled to go into effect on July 21, 2011, and while the Fed may modify this proposed rate reduction, credit card processors expect a dramatic reduction in the costs for debit card transactions.

The Federal Reserve has been granted the authority to regulate the costs charged by banks for Debit card transactions due to implementation of the Durbin Amendment. The revised cost that the Fed has proposed for Debit transactions is $0.12 per transaction, which is significantly lower than the rates currently charged. For example, Visa – the largest debit card processor through their Interlink network – currently charges 0.95% plus $0.235 per transaction for debit card transactions. The proposed changes are scheduled to go into effect on July 21, 2011, and while the Fed may modify this proposed rate reduction, credit card processors expect a dramatic reduction in the costs for debit card transactions.

Why didn’t I say “merchants” or your winery will expect this rate reduction?

This is because the cost reductions may or may not be passed along to you – the business owner. It’s clear that your credit card processors expect to have lower costs, but they may or may not choose to pass along the lower rates.

Most credit card processing accounts have a teaser rate or multi-tiered pricing structure, with different rates for different card types. With this traditional merchant account, debit card rate decreases will NOT be passed along to you the business owner because the rates that you pay are fixed. So when debit card costs shrink, the rate your business is paying is not automatically reduced, you’ll have to request a rate review and hope for a cost reduction.

But if you’re a Winery Payment Solutions client all cost reductions WILL be passed through to you immediately without any action required. This is because Winery Payment Solutions provides interchange pass through accounts so reductions in interchange rates or costs are passed through to your business immediately. We say bring on the cost reductions, our winery and related business clients can use the savings!

What if you don’t have an interchange pass through account?

Most credit card processors don’t offer interchange pass through, so it’s expected that the credit card processor will keep all the savings to themselves. Let’s be honest, most credit card processors are greedy and don’t miss any opportunity to increase your rates or retain your savings. The only way you can be confident that cost savings are immediately shared with your business is to have a true pass-through account offered by Winery Payment Solutions.

Our philosophy:

You’ve graduated to a higher level of service with Winery Payment Solutions and you will receive every cost reduction immediately and without asking. With Winery Payment Solutions you get the personal service you deserve and the savings are automatic, don’t settle for anything less.

April 2011

We receive calls from wineries and the wine industry suppliers who are not clients of Winery Payment Solutions who complain that their rates are increasing …AGAIN! So now they’re looking for a better partner. These rate increases typically happen in April and October when Visa/MasterCard/Discover announce their semi-annual rate changes. Most processors pass along these increases and add a little bonus for themselves to pad their profits. These other processors will put a tiny note on the monthly statement that their rates are increasing and then in a month the client realizes that they’re paying more to accept credit cards. Frankly, if you’re not with Winery Payment Solutions your processor is banking on the fact that you don’t read or even understand your monthly statement.

This April the card associations did announce some increases to their rates which only affect Supermarkets and also a few other insignificant changes to some rarely used card types. Once again, Winery Payment Solutions decided not to increase our client’s rates. We believe that we may be the only credit card processor who decided not to increase all of our client’s rates this April.

Here at Winery Payment Solutions we’re different, we do our best to stop “rate creep” so you know that your rates will not increase. When our costs as mandated by Visa/MasterCard/Discover increase we will pass those along at cost, but we never add anything extra to pad our bottom line, because what’s important to us is your bottom line and your continued faith and trust in us.

February 2011

Thanks to all the Oregon Wineries, Vineyards and Wine Related businesses that visited our trade show booth at the Oregon Wine Industry Symposium sponsored by the Oregon Winegrowers Association. We had a great response to our “Recycle your money back into your Winery” campaign. Congratulations to Kurt of Pheasant Hill Vineyard the auction winner of a new Hypercom M4230 Wireless Terminal. We appreciate all the bids and interest in getting paid anywhere with a wireless terminal or turning your iPhone or Android into a credit card machine with a mini credit card reader.

Here’s a photo of our booth:

January 2011

Winery Payment Solutions will be attending the Unified Wine and Grape Symposium in Sacramento, CA on Jan. 26-27. Look for us as we’ll be handing out a special offer to attendees.

Winery Payment Solutions will be attending the Unified Wine and Grape Symposium in Sacramento, CA on Jan. 26-27. Look for us as we’ll be handing out a special offer to attendees.

Coming in February, we’ll also be exhibiting at the Oregon Wine industry Symposium. Look for us in booth C-9 in the Hult Center, we’ll have special giveaway items and a special offer for attendees. We’ve also donated a wireless credit card terminal valued at $600 to the silent auction, so here’s your chance to acquire a great machine with the proceeds going to help the Oregon Winegrowers Association.

November 2010

We were at a conference recently with 250 other companies who sell credit card processing services. We’d like to call them our peers, but what we do is so different than these businesses that we’re apologetic to have to call them our competitors. We were both shocked by what we heard from these other companies and re-invigorated that we are on the right path to help wineries escape from these unscrupulous sales organizations.

We found ourselves in a room with middle aged men who would look more at home on a used car lot than in a hotel conference center. Yes the comb-over was prevalent, but worst of all the dodgy sales tactics were overflowing.

Here’s one that takes the cake – At Winery Payment Solutions we refuse to lease equipment to our clients, simply because it’s a bad deal for your business. We gladly post our prices for equipment on our website, starting at $199 for a basic terminal. Because you can acquire the equipment for so little, leasing the same equipment for $25 a month is predatory pricing and we simply won’t do it.

So we were shocked when a competitor proudly announced to us that they had found a way to lease Virtual Merchant access. Virtual Merchant is a website so you can submit your wine club orders, phone orders or integrate directly with your e-commerce websites. So, we provide a user id and password to a website so our winery clients can perform transactions. This competitor was proud to tell us that they “lease” access to Virtual Merchant for $23 per month to their clients. WHAT??? They “lease” access to a publicly available website? This is on top of a monthly fee to use Virtual Merchant.

The economics of this are scandalous. The competitor is committing the winery to pay $23 per month for 48 months which adds up to $1,104, for nothing. This is pure profit for the agent and purely disgraceful tactic to pad their bottom line.

We hope that you have not fallen prey to tactics like these as we work hard every day to educate our clients and provide honestly better payment processing services. Never lease your credit card processing equipment; we can help you along a better path.

October 2010

This month Bank of America announced that they estimate a decrease in their debit processing revenue of $1.8 to $2.3 billion starting in the third quarter of 2011 due to reductions in fees resulting from the debit interchange reform bill passed into law earlier this year.

According to the Nilson Report, Bank of America handles approximately 25% of the credit card purchase transactions in the US. So if Bank of America is correct in estimating the actual reduction in their income resulting from this law, this means that merchants accepting debit cards from all processors should expect approximately $8 billion dollars in savings per year. That’s an enormous cost reduction that will go directly to the US business owner’s bottom line… or maybe not?

We hope Bank of America is correct that the Durbin amendment will have a significant impact to help small and medium businesses reduce their costs. But what’s likely to happen is that credit card processors will not pass along the entirety of these savings to their clients, reducing the bottom line impact to your business.

At Leap Payments we take a different approach. With our interchange plus pricing plans every reduction in the interchange rates that are set by the card associations and now mandated by legislation are directly and immediately passed along to our clients. You don’t have to call us for a rate review or ask for the reduction, your savings are delivered automatically.

We’re confident that no other credit card processing company is willing to offer this guarantee to their clients. That’s our commitment to your winery and to your success.

September 2010

Most credit card processors allow you to process transactions for Visa, MasterCard, American Express, and Discover with a single device, but what they don’t tell you is that you’ll receive separate statements and deposits for your 1) Visa/MasterCard, 2) Discover, and 3) American Express transactions. So your bank statement will have up to 3 different deposits every day for your credit card transactions. This makes your accounting 3 times more difficult and worse yet you receive 3 different statements from different credit cards all with their own statement fees each month. In fact, we’ve seen statement fees from Discover up to $39.95 per month. Typical statement fees range from $4.95 to $19.95, so if you have 3 separate statements you could easily pay up to $50 or more each month just to receive your statements.

At Leap Payments we’ve simplified your credit card processing and consolidated all your credit card transactions onto one statement with no monthly statement fees. In addition, we make one deposit for all your card transactions, so you get paid faster and your bookkeeping is simplified.

How do you tell if a processor will force you to have a separate statement and maintain separate relationships with Discover and American Express? Read the really small print on their website or account application and you’ll see “separate approval required for American Express”. This means that this processor does not have the ability to provide integrated American Express processing and you will see separate deposits, separate account statements and additional statement fees. In fact 90% of processors do not offer consolidated statements for Visa, MasterCard, Discover and American Express.

Escape from junk fees and excessive statement fees with Leap Payments. We can even go one step further and put your gift card and electronic-check transactions on your single statement, so all of your card and check transactions appear in one place. We think this is simply better for you and it does save paper so it’s our small way of going green. If you want to be even greener, we offer online statements for every client – for free.

August 2010

President Obama signed the Financial Services Reform Bill into law which included a provision drafted by Senator Dick Durbin that placed Debit card interchange rates under the direct scrutiny and control by the Federal Reserve. So it looked like debit card interchange rates would be cut and savings passed along to struggling businesses. But not so fast…the lobbyists for the financial institutions have successfully killed this interchange law in committee.

The American Banker reported on July 30 that the Senate Appropriations Committee removed the interchange amendment from the law and instead agreed to study the impacts of such legislation. So what was expected to be about 9 months until the interchange regulation provided relief to businesses in the form of Debit card interchange reductions, now the timeline is uncertain. Certainly this study methodology and results will be aggressively debated in committee further delaying any definitive actions. This basically means that interchange regulation and potential interchange reductions imposed by the Fed will not be coming soon to help your winery.

So what’s next?

As Visa, MasterCard and Discover typically update the interchange rates every April and October, it will be very interesting to watch what happens this October. Will the impact of the legislation make the card associations reticent to make any changes hoping that the status quo will further dim the spotlight on these fees? Will they increase credit card processing fees claiming higher risk or network maintenance costs to boldly make a statement that their fees are justified and costs are increasing over time? Or will they react to the underlying sentiment that resulted in the creation of the interchange reform bill and attempt to appease businesses by providing reductions to interchange rates? Being students of game theory this will be an interesting move, and it’s in the hands of the financial institutions to set the tone for the ongoing discussion. Question is will it benefit your business or theirs?

What does this all mean for businesses that accept credit cards? For now not much as we don’t expect any changes to the interchange rates until October, and then the typical expectation is the rates or fees typically increase slightly. With rare exception this has been the pattern and we don’t expect this pattern to change. The difference this time is that we had a national dialogue about interchange rates, so actions will be more closely monitored.

We at Winery Payment Solutions are always looking for ways to save our clients the most possible on their credit card processing. We provide interchange pass through pricing to all clients because this saves your business the most money on your credit card processing and reductions in interchange rates are directly passed along to our clients. If your winery does not have interchange pass through pricing with your existing processor, it’s time to make the leap to Winery Payment Solutions.

July 2010

Assistant Senate Majority Leader Dick Durbin has successfully added a provision to the financial services reform bill that will allow “the Fed to issue rules to ensure that debit interchange fees are reasonable and proportional to the processing costs incurred.”

Basically business owners believe that they are being over-charged to accept a debit card which has led our elected officials to step in and regulate the fees and potentially provide some relief. While we don’t feel it’s our place to comment about what interchange rate is fair or not, our clients and prospects tell us every day that they are paying too much to accept credit and debit cards.

The debit card interchange rate for signature debit transactions (a transaction with a debit card processed without a PIN entry) was recently decreased by Visa to 0.95% plus $0.20 and MasterCard has set debit card rates at 1.03% plus $0.15. PIN debit rates vary based upon the network accessed and vary from 0.75% to 1.25% plus $0.10 to $0.20 per transaction. Assuming that the current version of the financial services reform bill is signed into law these rates will be under the direct scrutiny of the Fed.

Business owners commonly tell us that they consider accepting credit cards as “a necessary evil”. “Necessary” because their customers prefer to pay with credit/debit cards and “evil” because the business has no say about how much they’re charged to accept credit cards. Clearly these business owners believe that the fees to accept cards are neither reasonable nor proportional to the costs or value provided.

We believe it’s sad that the government has identified that financial reform is needed for debit card interchange rates, but we’re happy for our business owners that some relief may soon be coming their way. As a Leap Payments client, any reductions in debit interchange rates that result from debit interchange regulation will be directly passed onto our clients.

Many of our competitors, banks, and credit unions fought vigorously against this regulation as they will receive less revenue, but at Leap Payments we offer interchange plus pricing which means that whenever a rate decrease happens our clients will directly and immediately receive the benefit of the lower interchange rates. We think that’s good for our business and we know it’s good for your winery.

June 2010

We’re continually amazed by what our competitors will say that stretches the truth so excessively that it’s comical to us. Our clients report to us that sales reps from other companies have tried to convince them that they offer “wholesale” rates. So what is a wholesale rate? In the retail industry this would mean buying a product directly from the manufacturer or distributor instead of the retailer, thereby eliminating the retailer’s mark-up. So what would this wholesale concept look like for a financial service? The general concept to cut out the middleman sounds good, but for financial services it simply doesn’t translate as you’re buying a service not a product. In addition here’s no shipping and handling charges to process a credit card or move money from one account to another. For a service, there simply aren’t multiple hands that the service passes through before it gets to you.

For example, if you go to a bank’s headquarters location you get the exact same pricing that you get at the local branch, don’t you?

So what if you could get a “wholesale” rate for credit card processing? It would probably mean that you contracted directly with Visa/MasterCard for your processing. But that’s simply not possible, as they don’t work directly with businesses. Ok, so now you want to go direct to a processor for Visa/MasterCard… great. That defines most credit card processing organizations in the US. So does that mean that almost all credit card processors are wholesalers? We figure yes, so when you contract with a merchant credit card processing service, you are almost always getting what can be called wholesale rates. While it is possible to work with a sales rep from a processor who has their own sales reps, and so on who are all adding their mark-up to your fees; but that’s the exception not the rule.

Bottom line… what’s important to you are the actual rates that you pay, not the supply chain that provides the processing to you. Anyone can claim wholesale rates for financial services, but compare your actual rates to make sure that you’re getting a great deal. Leap Payments will gladly analyze your current statement to make sure that you’re paying as little as possible. We won’t pitch you that our rates are wholesale, our credit card processing solutions are simply better and our service is second to none.

Make the jump to a Leap Payments, no gimmicks, no sales pitches, just honestly better credit card payment processing.

January 2010

Unfortunately many credit card processing companies are playing a game to see how creatively they can hide fees and disclose as little as possible on their monthly statements. Even worse some just cut off your paper statement and make you go online to retrieve your information fully expecting that most merchants won’t bother. They use “Going green” as an excuse, but what they really want to do is reduce their postage costs.

This has led to the practice that many businesses simply give up trying to figure out all the fees that they’re charged and to make it simple they enter generic entries in their accounting software to try and account for the plethora of fees and transactions that appear on their bank account and credit card processing statements.

Leap Payments offers a better solution. We proudly deliver to you free of charge a paper statement each month and provide you access to online statements. If you want to go green we will gladly not print your statement, but that’s your choice. In addition, our statements are easy to read and detail all of your fees, no hide and seek here. And finally we only withdraw our fees at the end of the month, so your daily transactions match your bank deposits and you know exactly what you’re paying to accept credit cards. We don’t have anything to hide, and you don’t need to play games.

December 2009

Most merchants with other processors will experience the shock that the rate that they thought they were paying to accept credit cards is significantly lower than the actual rate that they’re paying each month. Why? Because many credit card processors sell teaser rates, such as 1.69% or even lower rates to bait unsuspecting merchants into signing up. These merchants are then surprised when they receive their first statement and see that they’re paying significantly more. These teaser rates are not applied to rewards cards and corporate cards which can account for more than 80% of the cards that a typical merchant accepts.

What are rewards cards and corporate cards? Rewards cards are simply credit cards that provide rewards such as mileage or cash back to the users and are more common than any other cards. Just look in your wallet and you’ll likely find a card that offers you either airline mileage, cash back or affiliation with an organization, these are all rewards cards. Corporate cards are those issued by a business to their employees and carry higher rates as well. The fact is that the business who processes the credit card actually pays for these mileage and cash back rewards via higher processing rates. These cards may reward the user, but they penalize the merchant.

So on your credit card processing statement you’ll see a “downgrade” fee for these cards. Some processors take these fees daily, and others lump these charges together in one charge at the end of each month. So that low rate that you thought you signed up for turns out to be much higher when you add up all the fees shown on your monthly statement. Some processors go a step further and make their statements so difficult to understand that the merchant simply gives up.

As a general rule of thumb 10% of your transactions will come from standard/qualified cards, 60% from mid-qualified/rewards cards, and 30% from non-qualified/corporate cards. So beware rewards and corporate cards and make sure that you ask your processor how much they will charge you for these cards as they make up the majority of the cards that you receive. If they tell you that all cards will be processed at the same rate, they simply do not know what they’re selling.

November 2009

The rate that you actually pay to accept cards is likely much higher than what you thought you signed up for. This rate is referred to as your “Effective Rate” and it’s really easy to calculate. You thought you signed up for a low rate of 1.79% or similar, do the math and you’ll learn a different story.

The best way to calculate your Effective Rate is to add up all the fees that you paid for credit card processing including interchange, discount, transaction fees, authorization, AVS, batch, monthly fees, terminal lease and rental fees, etc. and then divide this total by your processing volume. For example, if your statement lists fees of $325 for interchange or discount, $50 for transaction or Auth fees, and $25 for monthly fees; then you’re paying a total of $400 per month in fees. Assuming your credit card transaction volume is $10,000 per month, doing the simple math below provides your Effective Rate of 4.0%.

Total Fees Paid: $400

Total Credit and Debit Card Volume: $10,000

Effective Rate: $400 / $10,000 = 4.0%

That teaser rate that you thought you were paying, is not what you’re actually paying…Surprise!

Do this simple calculation or call us and we’ll be happy to help you calculate your actual Effective Rate. We’ll give you an honest assessment of your rates and fees and do our best to reduce your Effective Rate, because this rate is the one that matters the most.

September 2009

When it comes to credit card transaction fees we’ve all seen this happen too often lately: credit card processors charge additional per transaction fees for “mid” and “non” qualified transactions and then blame the credit card associations for the extra charges. Typically standard transaction fees vary from $0.20 to $0.25, but the new trend is to charge $0.30 to $0.35 for “non-standard” or “non-qualified” transactions. What’s a non-standard transaction and when does it occur? It can happen anytime you accept a rewards or corporate card or when you don’t swipe a credit card, meaning that the card is not present at the time of the transaction. Everyone accepts mileage or rewards cards issued by Visa and MasterCard, and sometimes runs transactions without swiping the card, and when you do and your account is not with Leap Payments your transaction fees could be higher.

Here’s the rub. On average 80-90% of cards are “non-standard” cards so these transaction fee increases affect almost every sale you make. How do you avoid these fees? Spend time to understand all fees and charges and choose a company that doesn’t add extra fees to your transactions. Leap Payments does not charge merchants extra transaction fees for “non-standard” cards. Run the numbers yourself when you compare rates and check your statement to ensure you’re not overpaying for credit card processing.

July 2009

Leap Payments was started because we got fed up with standard credit card industry practices and inexperienced sweatshop sales methods. Our industry is filled with providers who will sell their clients a package of payment solutions that look good at first with teaser rates, but surprise merchants after a few months with hidden fees listed on monthly statements that are impossible to understand. Another tactic is to lock the merchant into a 2-3 year contract and gradually increase fees. Equally damaging is the lack of sales rep knowledge and experience, so they may not even know or be able to explain how fees are assessed.

Have you ever asked a sales rep a question and found they don’t have the answer? Or been told that a fee is not important? In all likelihood they don’t know what their selling. It takes an average sales rep 2-3 years working in this industry to really understand how credit card associations assess fees, and how this affects each individual merchant. The fee tables from MasterCard and Visa are more than 300 pages long, and no rep with a few months on the job can confidently explain how your transactions will be processed and find you the best deal.

In addition, monthly statements for credit card processing are getting more and more complicated, so unless you have years of experience as a sales consultant you won’t be able to effectively explain everything that impacts your credit card processing account.

Leap Payments employees have over 7 years of industry experience on average, so you know that you’ll get industry experts who can explain the intricacies of your account and how changes to your transactions and moving your account to Leap Payments will be reflected in your bottom line. Without professional advice, you’ll be surprised every time your statement arrives. You deserve reputable payment processors who are ready to actively consult with your to ensure the best set of solutions for your unique set of payment processing needs.

Send your current statement to Leap Payments for a free, no obligation analysis and you’ll talk to an industry expert who will explain everything in plain English with as much detail as you’d like. You’ll learn more about credit card processing and find out the real benefit of working with a trusted experienced partner.