July 2011

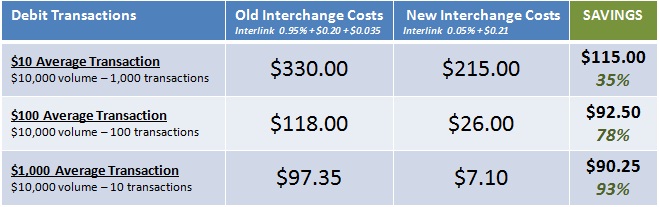

The Federal Reserve Board announced the final debit interchange caps related to the Durbin amendment. Some say that the Fed succumbed to pressure from the banks to retain most of the current rate structure, but savings will still be available to business owners. The Fed had previously proposed a debit interchange cost cap of $0.12, but the official cap imposed will be: $0.21 per transaction and 0.05%. This still represents a significant savings for your winery, but not quite as much as anticipated. Currently Interlink, the largest debit network, charges 0.95% and $0.20 per item plus an assessment of $0.035, so how will the new fee caps impact your bottom line?

For a Winery Payment Solutions client on the cost for debit transactions will decline from 0.7% to 1.15% depending upon your average transaction size and the specific debit network used for the transaction. In the examples above the new caps will reduce the actual cost of debit transactions from 35% to a whopping 93% for your winery.

While the Fed only sets the rate caps and each Debit network can price their service up to that cap, we’d be surprised if any Debit network prices their services under the current maximum amount allowed by law. This new cap’s implementation was also delayed from July 21, 2011 to October 1, 2011; so business owners will have to wait for a few more months to start seeing the savings.

Winery Payment Solutions is excited about these interchange caps imposed by the Fed as our clients will see significant savings on their debit transactions. If you’re not with Winery Payment Solutions already, make sure that your credit card processor is looking out for your best interests and will be passing along all the savings to your bottom line.